Do not Neglect To Issue In These Bonkers Curiosity Charges Into Your Automobile Funds

There are some actually good indicators that the automobile market is lastly shifting again to favor the patrons. Sellers are sitting on lots of stock, and offers are particularly sizzling on slow-selling EVs. Sadly, rates of interest are nonetheless excessive and that may actually make a distinction as to what’s reasonably priced versus what shouldn’t be.

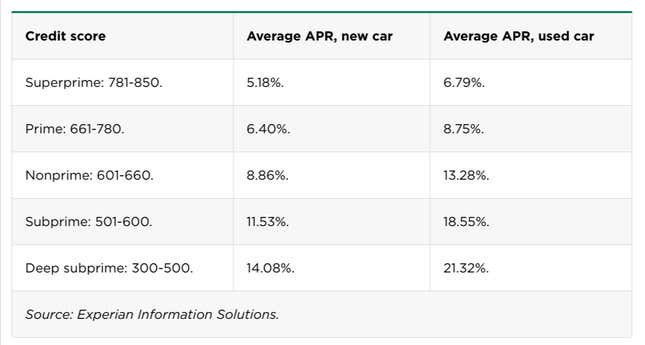

Accordingly Edmunds.com for the final six months, the typical rate of interest for a brand new automobile mortgage has been round 7%, whereas used automobile loans are averaging round 11%. After all, remember the fact that these are total averages which might be calculated from folks with very low to very excessive credit score scores. In case your FICO is properly above 700 you need to do a bit higher, however if in case you have some credit score challenges you possibly can be taking a look at a critically excessive auto mortgage.

NerdWallet has a chart by way of Experian that gives a breakdown of common charges per credit score profile.

So what does this all imply for people within the automobile market? I’ve mentioned loads of instances earlier than that to ensure that patrons to stop “overpaying” for a automobile, they should take an trustworthy have a look at their funds and set up an acceptable funds. How most individuals do that is to begin with a automobile fee that’s comfy, and work backwards to a complete worth. Nevertheless, with these elevated charges that is usually going to imply a less expensive automobile than many individuals anticipate.

For instance, in a earlier market, somebody with a 720 FICO credit score might get a producer particular of 1.9 APR for 60 months on a brand-new automobile and was comfy with a fee of $500 monthly. This purchaser might rating a car with a worth of about $28,600. Utilizing the present common charges of about 5.2 % and the identical phrases, that $500 monthly goal means the funds must drop all the way down to $25,600. Whereas that $3,000 drop would not appear to be a lot it might imply the distinction between getting a brand new automobile or pivoting to a used one.

For people purchasing for used automobiles, the scenario is much more difficult. As an instance you’re a purchaser with not-awesome credit score and have a FICO of just below 660 and are focusing on a fee of $400 monthly. In a earlier market, you’ll have certified for a mortgage of round 8 %, which on a 60-month time period would have given you a complete spending funds of just below $20,000. Discovering an honest, pre-owned automobile for twenty grand is not simple however actually doable. Proper now that purchaser may get a mortgage of 13 % which knocks that funds down $17,500. That places them in an much more tough market. For people with less-than-perfect credit score not solely are the charges a lot larger, there’s a likelihood they might not even get authorised for a mortgage.

Whereas some automakers are beginning to promote low-APR specials usually the effective print signifies that these charges are solely good for shorter time period loans at 36 months or much less. With one other price improve probably on the horizonit is extra important than ever that customers take a big-picture have a look at their funds earlier than they go to a dealership. And it is at all times advisable to buy your loans round between native banks and credit score unions along with the finance choices the vendor can present.

Tom McParland is a contributing author for Jalopnik and runs AutomatchConsulting.com. He takes the effort out of shopping for or leasing a automobile. Bought a automobile shopping for query? Ship it to [email protected]

Supply hyperlink